Cenario presents users with a list of clients ranked by payment status, allowing business owners to easily determine the payment habits of their entire client base.Whether you’re a freelancer working from home or a Fortune 500 enterprise with 100,000 global employees, recording financial business transactions is fundamental to your potential for success. One of the most interesting features of Cenario’s invoice and payment management functionality is the “client status” tool. The way in which Cenario presents expanded transaction information when compared to other generalized accounting platforms, such as Xero, allows business owners to gain an understanding of the cash flow status of their business at a glance.

The tracking functionality provided by Cenario delivers a simple overview of outstanding invoices and payments due with a simple summary of totals, combined with plain-english recommendations in a similar manner to the Cenario forecasting engine. Cenario’s payments functionality tracks invoices, payouts, transactions, and the status of business clients in order to deliver intelligent insights into the financial health of your business. “Cenario’s key features, such as smart and adaptive budgeting, one-click invoice chasing automation, direct debit capabilities, and dynamic tax calculation makes business finance simple, allowing business owners to spend less time playing with spreadsheets and more time on meaningful work.”Ĭenario splits invoice management and payments into two separate areas. If you’re already using Xero to track and reconcile transactions in business bank accounts this data can also sync with Cenario.īy intelligently collecting and interpreting financial data, Cenario is able to present businesses with detailed financial information at a glance via a streamlined dashboard.Ĭenario uses an advanced AI modeling system to find important patterns in your financial data and present it with intuitive graphs and real-time predictive analytics, delivering deep insights into the current status of your business.Ĭenario co-founder Vaibhav Namburi highlights the importance of Cenario’s scenario-based forecasting model for Australian SMEs: The Cenario platform is able to integrate with a variety of finance software such as Xero & QuickBooks in order to collect critical financial data. As a cloud-based platform, Cenario allows business owners to access their business finance data at any time, from anywhere - but the insights delivered by Cenario are the biggest advantage it delivers. Cenario provides business owners with detailed, easy to understand financial forecasting by connecting to existing accounting platforms, minimizing the time cost of complex financial analysis while maximizing control.Ĭenario is a versatile forecasting, budgeting, and invoice management tool designed to simplify business finance. Spreadsheets and siloed accounting systems are often inefficient, making it difficult to infer actionable insight.Ĭenario is an intelligent AI modeling platform that streamlines the cash flow forecasting and budgeting process. Managing the large amount of data necessary to perform accurate forecasting, however, can be difficult.

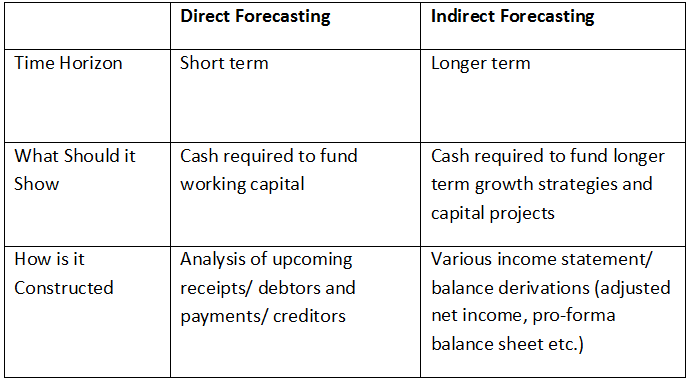

The importance of accurately budgeting, forecasting, and following up invoices can’t be understated - Australian SME invoicing data reveals that Aussie businesses lose over $19 billion annually due to late invoice payments.Īccurate cash flow forecasting and budgeting allows your business to predict future sales or inventory status, demand, or outstanding invoices. Cash flow forecasting & management is an essential practice that allows business owners to optimize available cash reserves, predict financial outcomes, and help identify potential cash shortfalls before they occur.

0 kommentar(er)

0 kommentar(er)